On 27 October 2021 the Chancellor, Rishi Sunak, presented his new Budget alongside a three-year Spending Review.

The Chancellor announced and reaffirmed a number of measures that will impact the UK’s arts and cultural life.

Departmental budgets

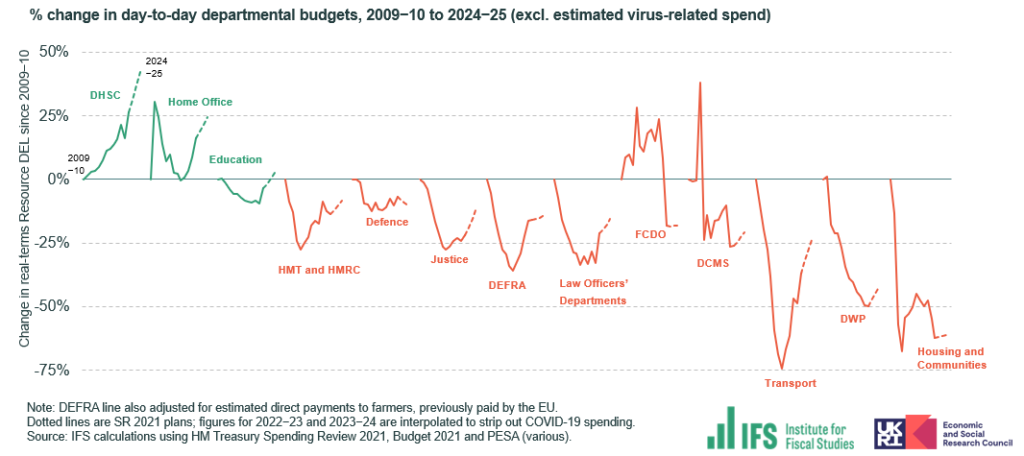

The Chancellor announced increases in funding for all Government departments. This will allow them to spend more than in the current financial year.

All but three departments will nonetheless have lower funding levels for day-to-day spending than in 2009-10 – this has led the Institute for Fiscal Studies to say that “austerity is over, but not undone”.

Department for Digital, Culture, Media and Sport

The DCMS is responsible for protecting and promoting art and culture in England. It will receive a £0.6bn cash increase over the Parliament to £2.7bn in 2024-25, which is equivalent to a real-terms growth rate of 2.9% per year on average.

It is not yet clear how much of this funding will be allocated to culture specifically, including Arts Council England. This is being decided now by the DCMS in consultation with the Treasury.

Funding settlements for Creative Scotland, Arts Council Northern Ireland and the Arts Council of Wales will be decided separately by each of the devolved administrations, whose overall UK Government funding will increase, on average, by £4.6bn per year in Scotland, £2.5bn per year in Wales and £1.6bn per year in Northern Ireland.

The Youth Investment Fund, which the Public Campaign for the Arts petitioned Rishi Sunak to deliver, was re-announced in the Budget as part of a £560m settlement for youth services in England. However, this settlement includes the costs of running the National Citizen Service (currently £178m per year). As a result, Labour has accused the Chancellor of a ‘stealth cut’ to the £500m originally pledged for the Youth Investment Fund in the 2019 Conservative manifesto, which they say may be as large as £400m+.

Department for Education

The DfE is responsible for education and children’s services in England. It will receive a £18.4bn cash increase over the Parliament to £86.7bn in 2024-25, which is equivalent to a real-terms growth rate of 2% per year on average.

It is not yet clear whether this funding increase will enable the delivery of the Arts Premium, which Rishi Sunak promised in the March 2020 Budget but which was noticeably absent from this one.

Department for Levelling Up, Housing and Communities

The DLUHC oversees local government in England, and promotes community cohesion and regeneration across the UK. It will receive a £2.6bn cash increase over the Parliament to £8.9bn in 2024-25, which is equivalent to a real-terms growth rate of 4.7% per year on average.

Core spending power for local authorities is estimated to increase by an average of 3% in real terms each year. However, the Institute for Fiscal Studies has said that after the cost of the Government’s reforms to social care, existing council services (including social care) will only receive an uplift of 1.8% in real terms each year – lower than the 3.3% average for Government departments and far below what the Local Government Association said was necessary. According to the IFS, this makes “cuts to some council services likely without additional funding from central government, given rising costs and demands”. Local Government funding for the arts is already severely threatened across most of the UK, and fell in England by 43% between 2008/9 and 2017/18.

The first recipients of the £4.8bn Levelling Up Fund and £150m Community Ownership Fund were announced with the Budget. Of the 105 successful bids to the Levelling Up Fund, only 5 are expressly for arts and cultural projects.1 It is not yet clear how much of the remaining £3.1bn of funding will support arts and cultural assets (though they are eligible). We may get more details in the Levelling Up White Paper, which will be published later this year.

Cultural tax reliefs

The Chancellor announced temporary increases in the rates of three corporation tax reliefs, collectively known as the ‘cultural reliefs’:

| 27 October 2021 – 31 March 2023 | 2023/24 | 2024/25 onwards | |

|---|---|---|---|

| Theatre Tax Relief (TTR) for theatre production costs | 45% (50% for touring) | 30% (35% for touring) | 20% (25% for touring) |

| Orchestra Tax Relief (OTR) for orchestral concert costs | 50% | 35% | 25% |

| Museums and Galleries Exhibition Tax Relief (MGETR) for exhibition costs | 45% (50% for touring) | 30% (35% for touring) | 20% (25% for touring) |

The measure is intended to “support theatres, orchestras, museums and galleries to recover from Covid” and is expected to benefit approximately 1200 companies that claim these reliefs annually.

The Creative Industries Federation said it was “hugely welcome”. However they were disappointed by the limited expansion of Research and Development tax relief, which continues to exclude many in the cultural sector.

Business rates relief

The Chancellor announced a temporary, 50% cut in business rates in England for companies in the retail, hospitality and leisure sectors, up to a maximum of £110,000. Music venues, cinemas and theatres are included and were mentioned specifically.

Business rates are charged on commercial premises based on the value of the property and the level is set by central government, rather than by councils. They are devolved across the UK’s nations.

Arts-related spending commitments

Now that the Chancellor has set their funding for the next three years, Government departments such as the DCMS will be able to make detailed plans for investment. However, some arts-related commitments were announced or reaffirmed by the Chancellor in his Budget:

- As previously announced, “over £850 million” will be invested between now and 2024-25 in “cultural and heritage infrastructure”, restoring and upgrading institutions such as the V&A Museum, Tate Liverpool and Imperial War Museum in Duxford.

- £800 million has been allocated for the Live Events Reinsurance Scheme.

- £500 million has been allocated to extend the Film & TV Production Restart Scheme.

- “Over £480 million” will be spent in 2022-23 for “a year of celebration across the UK”, including ‘Unboxed: Creativity in the UK‘, the Commonwealth Games and the Queen’s Platinum Jubilee.

- £52 million in “new funding for museums and cultural and sporting bodies” next year, plus an additional £49 million in 2024-25, to support recovery from Covid-19.

- £42 million of scale-up funding for creative SMEs (a new version of the Creative Scale-Up programme, the extension of the UK Global Screen Fund, and the extension of the UK Games Fund).

- This is less than DCMS pitched to cover creative industries specific programmes, so both the Creative Careers Programme and Export Office bids were dropped.

- Maintained funding for the UK City of Culture programme, which “honours the great cultural diversity of cities across the UK through culture-led regeneration”.

Not in the Budget or Spending Review

Arts Premium

The Arts Premium promised by the Chancellor in the March 2020 Budget was noticeably missing from this one. The Public Campaign for the Arts continues to petition for its delivery.

Targeted support for freelancers

In response to the Budget, FreelanceUK said the Government “could do much, much better for individual creatives who freelance as self-employed sole traders”. According to research by Freelancers Make Theatre Work, 71% of the theatre workforce are freelancers, and 38,000 freelancers left the creative industries in 2020.

Details of Higher Education and Further Cultural Learning investment

The Cultural Learning Alliance has noted that funding has not currently been allocated to areas where the Department for Education has historically invested in cultural learning, such as Music Hubs and wider initiatives such as the National Youth Dance Company. They say “this funding is critically important to children and young people’s social mobility and life-chances”.

Moreover there was no detailed information on funding for Higher Education. ‘High-cost subject funding’ for creative courses has just been cut by 50%, opposed by over 167,000 supporters of the Public Campaign for the Arts, and a recent report suggested that ministers could limit the number of students able to take arts degrees in England. The Government’s plans will be published “in the coming weeks” alongside its response to the Augar report.

Support for touring artists

David Warburton MP, chair of the All-Party Parliamentary Group on Music, has said that “musicians and crew are facing an enormous and grave problem when it comes to touring the EU that is not going to go away”.

The Budget contained no new measures to address this issue, such as the bespoke music export office proposed in David Warburton’s recent letter to the Prime Minister.

In January the Public Campaign for the Arts mobilised over 16,000 people to lobby the Government over visa and work permit issues restricting artists after Brexit. It remains a pressing concern.

You can read the full budget document here and the the Office of Budget Responsibility’s independent report here.